nebraska property tax calculator

Updates to the Nebraska Property Tax Look-up Tool Nebraska Property Tax Look-up. This mortgage calculator will help you estimate the costs of your mortgage loan.

How To Calculate A Michigan Homestead Tax Credit Sapling Tax Deductions Income Tax Tax Credits

Pete Ricketts announced the new online service on Wednesday.

. Maximum Local Sales Tax. Nebraska launches new site to calculate property tax refund. Average Local State Sales Tax.

The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. This information only applies to the Countys General Fund agencies for Fiscal Year. AP Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool to help them calculate what theyre owed.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The first thing you need to figure out is your Nebraska income tax rate. Whether you are already a resident or just considering moving to Nebraska to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

If you buy the property in the middle of. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Learn all about Nebraska real estate tax. Maximum Possible Sales Tax. Get a clear breakdown of your potential mortgage payments with.

Most taxpayers pay fall into the second and third tax brackets because of the average income made by Nebraskans. About Your Property Taxes. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000.

Nebraska is ranked number seventeen out of the fifty states in order of the average amount of property taxes collected. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Lincoln County. Just enter the five-digit zip code of the location in.

You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223. The median property tax on a 10910000 house is 114555 in the United States. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription service as well as sign up for automatic emails when DOR updates information about this program.

AP Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool. County AssessorDeputy County Assessor Examination August 11 2022. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Nebraska launches new site to calculate property tax refund. The lowest tax rate is 246 and the highest is 684. This income tax calculator can help estimate your average income tax rate and your salary after tax.

Nebraska Salary Tax Calculator for the Tax Year 202223. There are four tax brackets in Nevada and they vary based on income level and filing status. The median property tax on a 10910000 house is 192016 in Nebraska.

Nebraskas state income tax system is similar to the federal system. Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year. Our calculator has been specially developed in.

Simply input your current property value and find out where your County tax dollars go. Its a progressive system which means that taxpayers who earn more pay higher taxes. Sarpy County real estate taxes are levied in arrears.

Nebraska State Sales Tax. For comparison the median home value in Nebraska is 12330000. To show how your Lancaster County tax dollars are spent we have developed this calculator which breaks down your County taxes only by General Fund agency.

For example the 2020 taxes are levied at the end of 2020 and become due on the last day of December 2020. The Registration Fees are assessed. State tax officials and Gov.

The Nebraska tax calculator is updated for the 202223 tax year. Nebraska income tax brackets range from 246 to 684Nebraska uses a progressive tax rate system meaning that higher levels of income are taxed at higher rates. 1500 - Registration fee for passenger and leased vehicles.

If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37 depending on your income.

There are no local income taxes in. The Nebraska income tax calculator is designed to provide a salary example with salary deductions made in Nebraska. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. Nebraska Income Tax Calculator 2021. The average salary for.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

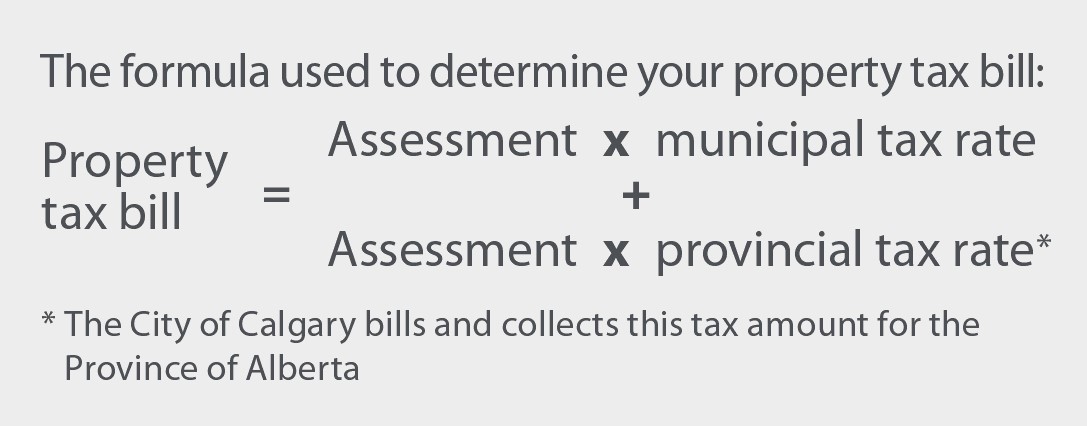

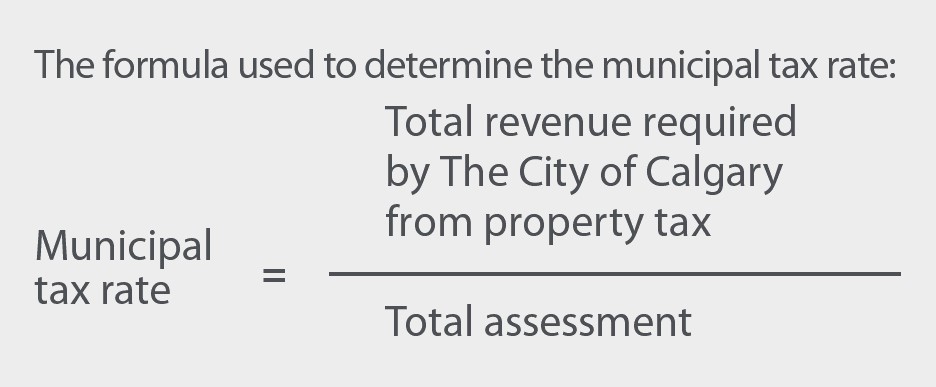

Property Tax Tax Rate And Bill Calculation

Property Tax Calculator Casaplorer

Free Money Worksheets Addition Subtraction Sales Tax And Next Dollar Up Money Worksheets Money Math Worksheets Teaching Kids Money

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

2022 Property Taxes By State Report Propertyshark

Property Tax How To Calculate Local Considerations

Property Tax Tax Rate And Bill Calculation

Corporate Tax Meaning Calculation Examples Planning

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Marginal Tax Rate Formula Definition Investinganswers

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Income Tax Calculator 2021 2022 Estimate Return Refund

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

Alberta Property Tax Rates Calculator Wowa Ca

Tax Calculator For Items Hot Sale 58 Off Www Ingeniovirtual Com

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)